WHY NJ LENDERS CORP

If you fail to meet certain conditions when using it, you will be made liable for tax penalties under the law. A custodian is an official entity with the necessary licenses for administrating SDIRAs and storing gold and other precious metals purchased as an investment. This event went off flawlessly so this year I sold a lot of my stock and again invested it into Precious Metals with Goldco. With its strong focus on customer care, transparent pricing, and a wide range of IRA approved precious metals, Noble Gold Investments is an excellent choice for investors of all levels looking to invest in precious metals and secure their financial future. Learning how long a gold company has been in business is critical. Com, 37% best silver ira 2023 of gold, excluding bullion, is used for electronics in America. Sign up now to receive the ultimate guide to gold ownership, unlock special offers, and more. Call CGE at 1 800 300 0715 to confirm your buying at the best possible price, it takes less than 2 minutes.

7 Gold Alliance: Best For Low Cost Gold and Silver Investments

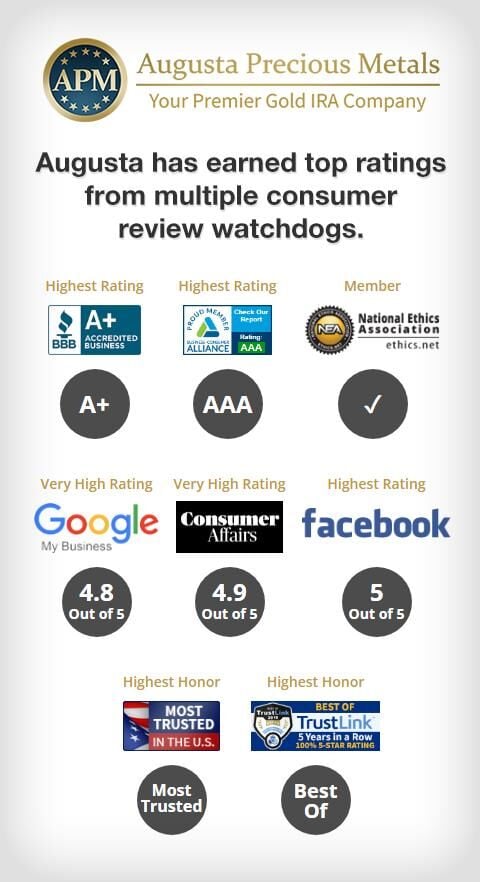

Gold IRA reviews can provide an overview of the fees associated with each broker or custodian. Gold Investment Coins / Bars. The company enjoys an A+ rating with the BBB and a perfect 5. Gold IRA custodians are responsible for providing the gold bullion and other precious metals to be held in the gold IRA. Investors can also roll over their existing 401k, or 403b accounts into precious metals IRAs. Additionally, he helps individuals plan holistically for their future and make sensible, informed alternative investments, such as gold and digital assets. Since 2003, Birch Gold Group has been selling physical gold, silver, platinum and palladium to fund IRAs or for physical possession.

Let’s Discuss IRA Eligible Silver

American Hartford Gold. With their commitment to providing quality service and products, Noble Gold is an excellent choice for anyone looking to invest in gold and silver IRAs. This service is mostly offered to customers who buy non IRA precious metals. Gold is only taxed when sold. You understand, acknowledge and accept that there is a price differential or “spread” between First Fidelity’s selling price the “ask price” and First Fidelity’s buyback price the “bid price” for coins First Fidelity needs. It may be a good move to buy insurance to protect your assets. No income documentation required.

How Can I Avoid Taxes and Penalties for with Liquidating an IRA to Buy Gold?

Precious metals can be held in your IRA in the form of physical allocated or unallocated gold and silver bullion, certificates, and Exchange Traded Funds ETFs. Increase Returnon Investment. Discover the Benefits of Investing in Precious Metals with Birch Gold. Rosland Capital cannot guarantee that the information herein is accurate, complete, current or timely. Unlike traditional IRAs, which limit investments to stocks, bonds, and mutual funds, a silver IRA allows individuals to diversify their portfolios by including precious metals. You may have to pay for shipping, but you can sell your gold however you see fit. The company’s secure storage solutions provide investors with peace of mind, while its customer service team is always available to answer any questions or concerns. He has a lot of experience helping senior citizens plan their financial future. If you’re in search of an alternative to mutual funds and other funds in your retirement account, gold IRAs might be worth considering.

Top 5 Precious Metals IRA Companies

Depending on your custodian, you may be allowed to own silver and gold bullion coins or bars. We are pleased we chose Mark through our Realtor’s referral. If you take withdrawals from your IRA early, before 59 1/2, you will be assessed a 10% penalty by the IRS. A Roth IRA is a special type of retirement account that allows you to invest in silver and other precious metals. No more than 4 marketing msg/month. DO NOT give this authority to a precious metals dealer. However, there is an annual service fee of $80 for all accounts along with a yearly storage charge of $150 for segregated storage, which is available for all accounts irrespective of their size. Homeowners looking to tap their equity may have fewer options with Wells Fargo.

Step 3: Select Your Metals

Many of the companies listed offer both gold and other types of precious metals. It’s always seeking guidance from reputable financial advisors and trained and experienced experts within these types of accounts for understanding better decision making in matters of finances or taxes. Invest In GoldCo For A Golden Future. You must roll the funds into a silver IRA. Their commitment to providing quality services and reliable advice has earned them a great reputation in the industry. This year, I closed that traditional IRA and put it into my Noble Gold IRA. Goldco is a Los Angeles based company that has over a decade of experience in the gold industry. When rolling over to a gold and silver backed IRA, investors must ensure that they follow the IRS guidelines to avoid penalties or taxes. Investing through a self directed IRA provider also has its risks; although it offers greater diversification opportunities than buying physical metal coins does there could still be significant losses if market conditions change suddenly or if fraud occurs within the company managing your assets. Unsure whether gold IRAs are right for you.

Lear Capital: Summary Best Gold IRA Companies

Midland works with the following depositories to store metals. Apart from a high rating on Better Business Bureau, Birch Gold Group is also endorsed by the Ben Shapiro Show, boosting the company’s overall credibility. Minimum purchase $1,500. The best way to invest in gold will depend on your individual investment goals and objectives. Like other investments, it’s nearly impossible to predict the state of these factors with certainty. There are also a number of prohibited transactions and disqualified persons. If you have already weighed the pros and cons and are still interested in opening a Gold IRA, the following will walk you through the process of doing so. GoldCo is a well established Gold IRA company that offers a range of investment options, including physical gold, silver, platinum, and palladium. You can even try some Australian Koala Bullion Coins or Canadian Maple Leaf coins while you are just starting out. Allocated, also called segregated, means that your metals will be separated from metals owned by other investors and stored in their own space. If you buy through links on our site, we may earn a commission. Once you’ve chosen the dealer, you can purchase and add precious metals to your investment portfolio.

Investments You Choose

If you want to keep up with precious metal prices, American Hartford Gold can help you do just that. Orion Metal Exchange specializes in the buying and selling of ferrous, non ferrous, precious and specialty metals. With over 10 years of experience in the industry, GoldBroker has a deep understanding of the precious metals market and provides clients with a secure and reliable alternative for their retirement savings. A precious metals IRA gives you the ability to invest in a variety of gold and silver products such as coins, bullion, and rounds. City DeskLoose LipsHousing ComplexCoronavirus. No charges for selling the investment.

Patriot Gold Club: IRA Accounts Silver IRA

Selling your car or jewelry often does not take long, so if you had to sell one car in order to make mortgage payments, you could do so in a reasonable amount of time. It’ll give you more peace of mind to shift from riskier investments like stocks to more stable assets like gold. First Step You begin the process of rolling over by opening a new Silver IRA account. Nowadays, many professionals offer discounts for their services or give you special offers, with and without personalized advice. No investment comes without any risks. A Gold ETF invests directly into the price of gold bullion without having to buy physical gold itself. Here are the most reputable gold IRA companies. Learn more about our Wealth Planning services or contact your qualified tax advisor. The company emphasizes the importance of physically owning and storing gold or silver bars and coins outside of the traditional banking system. It focuses on helping customers and families build their wealth by offering high quality products and allowing them to open gold and silver IRAs, which allows them to diversify their portfolios. Augusta Precious Metals has great reviews and competitive pricing. Therefore, clients who want to know if they can apply should contact the company’s customer service and learn as much about the process as possible. 995+ fineness and be hallmarked by a NYMEX or COMEX approved refiner/assayer. You need to know the policies of each precious metals IRA storage depository.

PROCESSES+

9 stars on Google My Business, and 4. Investing in a precious metal IRA is relatively easy. The intent is to stop account holders from using or accessing IRA assets for personal benefit because doing so would be tantamount to a fully taxable distribution. Historically, precious metals have tended to do well during times of economic uncertainty or inflation, so they may protect long term purchasing power. Your self directed account can purchase physical gold, silver, platinum, and palladium from the sponsor of your choosing. They provide a wide range of services, from gold IRA setup to gold IRA rollover, and offer competitive rates for its clients. Customers can enjoy affordable rates with a flat service and storage fee. Take the Leap and Invest in Gold with Patriot Gold Club. These include storage costs for safeguarding your gold and silver products, potential tax implications, and the overall illiquidity of the physical assets compared to traditional investments. Visit the Investment District. However, when it comes to gold and silver, things might be different. A more pressing question, however, is how to safeguard your retirement savings. With unallocated or unsegregated storage, the metals are comingled in a depository metal account. Second, the account holder contacts their preferred precious metals IRA company to formally initiate the transfer of funds.

GoldStar Trust

Considering that setting up IRA accounts can be quite a complex process, you’ll want to choose a company with excellent customer service to help guide you through your decisions. A narrow range of available asset types is further restricted to 2,094 stocks and 251 ETFs. The IRS strictly prohibits the personal storage of gold and precious metals. Victoria Weekend Hours. 1431 Greenway Drive, Ste. They keep their investment property mortgages in house, on their own portfolios, so they’re far more flexible than conventional loan programs. Box 870 Murray, KY 42071 888. Silver IRAs are approved by the Internal Revenue Service and are a great way to diversify your retirement savings. You get support for the entire lifetime of your accounts. To qualify for an IRA, silver must be at least. As for the platform’s gold selection, you can buy assets like American Eagles, Canadian Maple Leafs, American Eagle Proofs, Gold Canadian Eagles, American Buffalo, and Australian Striped Marlin. →Glossary of Landlord Loan Terms. Additionally be aware that precious metals carry risk of loss and are not a suitable investment for everyone.

What’s The Signup Process Like?

Simply click on the image to the left to be directed to our IRA site. It’s why it’s essential for clients to be able to trust the company they’re working with. Retrieved June 7, 2023, from. If you’re interested in a gold IRA, be sure to consider these drawbacks. A gold and silver IRA can provide a stable and secure way to invest in precious metals for retirement. It’s cheaper than gold and it has more industrial uses. Q: What is a gold and silver IRA. Noble Gold has a dedicated team of IRA specialists and a variety of investment options, while Patriot Gold is a great option for those looking for a more personalized experience. If the value continues to shrink, paper heavy assets could be worth a lot less in retirement. A precious metal IRA is just like a retirement savings account. This way, you get your metals or cash, and the government can collect the taxes owed on the holdings. We are a third party administrator who is disqualified by the IRS from giving out any investment advice. Be careful when you shop around for Gold IRA companies because many of them are known to push collectibles and numismatics to their clients to raise their profit margins.

SILVER PRODUCTS

If a person is looking to invest in a precious metals IRA, there are many associated costs that should be reviewed and considered. People are not able to open a precious metal IRA account from scratch sometimes. With their buyback program, you don’t have to scout for a reliable dealer to sell your precious metals to get a profitable return on investment. It has a long standing reputation for providing reliable gold IRA services and a knowledgeable team of experts to provide customers with the best advice. 30% 50%+ profit margins on numismatic coins are very attractive margins for some brokers. In accordance to IRS standards, all precious metals must be held in a facility approved by the IRS. According to reviews, the staff at American Hartford Gold is very attentive and professional. This compensation may impact how and where products appear on this site including, for example, the order in which they appear. CreditDonkey is not a substitute for, and should not be used as, professional legal, credit or financial advice. Landmark Capital is a premier precious metals firm that offers outstanding, sound, and reliable information to serve our clients locally and nation wide. The best gold IRA companies such as Goldco and Birch Gold Group offer great advantages, such as unbeatable customer service, security, and competitive fees. Metals such as silver and gold offer many benefits to investors. APIA NIB Silver Premium Plus, $236 per month.

Meet Our Experts

If you choose to take physical position of your coins, it will be treated as a distribution. Gold and silver are two of the most reliable and valuable investments available, and when combined with a traditional retirement account, they offer a secure and profitable retirement plan. The highly qualified staff of Orion Metal Exchange will help you buy, sell, and store precious metals in your IRA. Silver IRA accounts can provide investors with a hedge against economic downturns, inflation, and other potential risks. The company offers a range of secure payment options and provides a safe and secure environment for customers to make their transactions. Fees and Requirements. Below are a handful of popular IRA approved silver bullion bars we carry.

Company

Unallocated means that your metals will be commingled with other investors’ metals. Their knowledgeable staff is knowledgeable and always willing to answer questions and provide assistance. You will simply give directions to your custodian in order for them to start purchasing precious metals. Your precious metals supplier will guide you through the process. Will the government dip into your retirement accounts to pay off its massive debt. At Summer Lawyers, we act to ensure our clients’ security interests are perfected and registered correctly, safeguarding you in the instance of recovery. When it comes to customer service, they take the time to understand each investor’s unique financial goals and tailor their recommendations accordingly. Gold IRA companies will vet depositories for factors like security, compliance, and convenience. Schedule a call with anIRA Counselor. If you are unsure about the best way to store your precious metals IRA, consult a financial advisor. While there are various loan lenders online that offer Gold IRA services, it’s essential to choose the right one to ensure that your investment is secure and legitimate. You acknowledge First Fidelity does not guarantee a profit or growth in any time frame. Always do your own due dilligence before purchasing a product.

Contact Us

This led to the dilution of restrictions and the traditional banking functions that we know and appreciate today. This makes it an attractive option for those who want to preserve their purchasing power without facing the risks of traditional investments like stocks or bonds. Further, Goldco works with all major Self Directed IRA custodians. Each coin is struck by Bulmint from 1 oz. To invest in Lear Capital, a minimum of $25,000 is required as the initial investment, although it is not clear from the website if this amount has been revised. They then test the metal and manufacture their branded products which they sell to authorized dealers. Goldco: Best business ratings and customer service.

Advertising

>>Try Augusta Precious Metals to get the best gold IRA. Their knowledgeable staff can help customers navigate the process of setting up a silver IRA, making it easier to take advantage of this valuable investment opportunity. IRA amount options range from $25,000 to $500,000. Discover the Benefits of Investing with American Hartford Gold Group Today. > Get a Free Web Conference With Their Harvard Economist. Each provider has their own set of fees and services, so it’s important to compare them and find the best option for your individual needs. Help investors secure Single Family Rental or 2 4 unit financing – no tax returns required. Self Directed IRA You control what investment assets to hold in the account such as real estate, precious metals, mutual funds, hedge funds, REITs, bonds etc.